THE LEVY GROUP JOINS TENANT REP CHANNEL’S GLOBAL ALLIANCE

We are proud to announce The Levy Group has joined TRC’s global alliance as their London Tenant Rep partner.

Having successfully conducted conflict-free cross-border and Trans-Atlantic commercial real estate business since 1976, Martin commented ‘I was thrilled to receive an invitation to join TRC’s ‘best in class’ team of international Tenant Reps strengthening our global reach and partnering with an elite group of North America’s most seasoned and influential brokers ensuring our valued clients (and theirs) will receive the most unbiased, informed and cutting edge commercial real estate advice.’

Martin is an expert in relocating talented people to new business space, restructuring an existing lease or helping businesses expand within their current location so you’re in safe, experienced hands with the skills to make your team happier, healthier and more productive.

Level the playing field in lease negotiations with your landlord and get everything you deserve and more.

Click here to view our worldwide global partners

Time To Get Real

As a pioneering tenant rep it’s in my DNA to push landlords. I’ve spent more than 40 years aggressively negotiating lease breaks, fighting rental penalties, securing service charge caps and extracting capital contributions from often reluctant or unwilling building owners.

But if coronavirus has taught me anything during this (hopefully) once in a lifetime crisis is that if your business needs help, now’s the time to reach out and ask for it.

The UK government has established a Lease Forfeiture Moratorium which prohibits a landlord from forfeiting a business tenancy or instituting legal proceedings for non-payment of rent between 25 March 2020 and 30 June 2020. The new legislation also provides for the Government to extend this initial period if it considers it’s appropriate.

Admittedly many tenants are guilty of blatant opportunism by demanding reductions, rental holidays or simply withholding payments which in some cases is frankly embarrassing – while for others it’s a battle for survival.

With certain exceptions, I’ve found landlord’s responses to cases of genuine hardship frustratingly inconsistent.

On the one hand my own landlord (a respected law firm) to their credit immediately offered their valued tenants an initial 80% reduction in their fees from 23 March until 30 April 2020 – albeit without prejudice to their rights under contract – with an assurance to review matters on a month-to-month basis.

Conversely, another landlord has requested the ‘full belt and braces’, ie. audited accounts for my client, their US parent and management accounts for each entity before they will even consider any request for a rental deferment.

I get it that landlords need to balance its desire to support their tenants through this unprecedented time with its obligations to other stakeholders but for heaven’s sake my client hasn’t be able to access their building since 16 March !

Monthly payments may alleviate a short term cash-flow challenge but landlords have Loss of Rent Insurance and if they haven’t I’ve got an incredible team of brokers at Square Mile Insurance Services in Aldgate who I’d be delighted to recommend.

I’m not advocating deferring 100% of my client’s contributions across the board since I believe it is crucial to maintain service charge payments allowing building facilities to continue to function smoothly and without interruption for when we’re feeling comfortable to get back on the tube and train or queue for a sandwich or a pint.

I’ll be happy to discuss your options by carefully reviewing your lease, its obligations and the impact that the COVID19 pandemic may be having on your business.

While you’ll be using this surreal time to recalibrate your principle business objectives I’d also urge you to pick up the phone and check-in to see how your clients, contacts and friends are coping too. Share your thoughts, experiences and suggestions and see what you can do to help.

Showing empathy is not a weakness.

All being well, we’ll all come out the other side with an increased level of compassion, community and respect for one and other … so long as we don’t run out of loo roll !

Stay safe.

No Brexit, No WeWork and definitely no VAR

When I started out my first ‘boss’ recommended that I get out and meet my ‘twenty something’ contemporaries which was great advice as many are still friends more than forty years later.

But as I got older and more ambitious I started my own business in 1985 (I was no overnight sensation !) and realised I needed to get closer to potential clients and connect with a whole host of what we now know as ‘influencers’ which is just another fancy word for smart, limitless business savvy leaders. So the opportunity to watch, listen and learn from the truly inspirational visionary Cameron Herold (@CameronHerold) at a recent Entrepreneurs’ Organisation event in London (@EntrepreneurOrg) was something I couldn’t miss.

My point is that while it’s essential to know your main industry players (and mine are spread across the globe from the States to Australia and the Far East and I’m continually grateful for their trust, support and confidence in looking after their valued clients) we all need to get out there and mix, aka ‘network’ with groups that at least have a common thread.

Evenings spent playing indoor golf, bowling, axe throwing (!!!) and dressing up as your favourite cartoon character just shows you how far we’ve come in after work pursuits.

Since I love to recommend other professionals I’ve successfully worked with (whether they’re solicitors, project managers, technical consultants or workplace specialists) you can’t accomplish any of this sitting behind your keyboard.

One-to-one’s or networking in a crowd of strangers is exciting – I guess kind of like dating again which is why I haven’t resorted to circulating my online profile just yet plus you get to see me up close whether at a cocktail event in London or a seminar in San Francisco.

I’m also available for weddings, barmitzvah’s and panel discussions J

PS I’ll happily explain VAR to the uninitiated but Brexit is off limits !

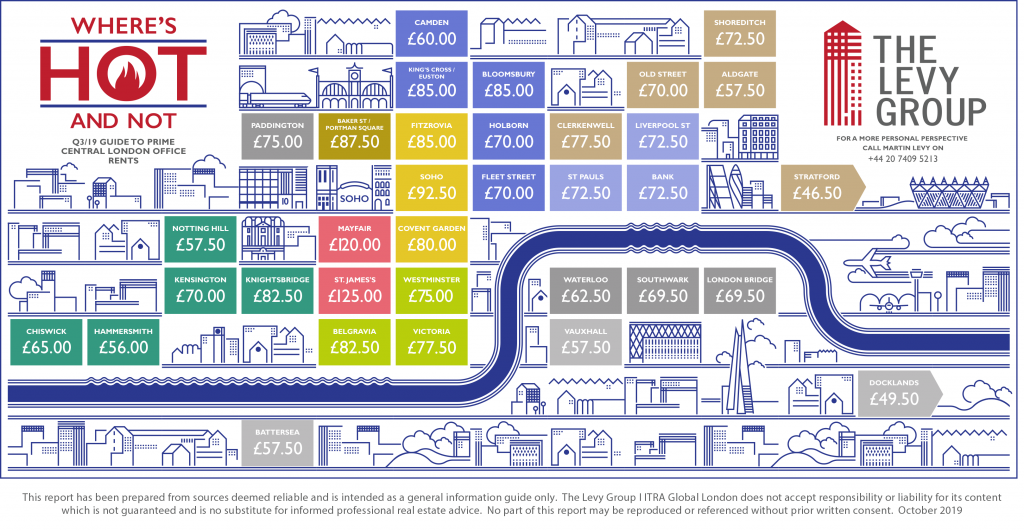

Where’s Hot And Not Q3/2019

Ground breaking savings – Paddington

The Levy Group, exclusive London real estate advisors to Keller Group Plc, one of the world’s largest independent geotechnical solutions specialists, have successfully negotiated a rent review on a suite of 6,020 sq ft at 3 Sheldon Square, Paddington Central, W2 achieving total saving of £350,000 over the remaining 4 years of a sublease from VISA International. Keller Group (listed on the London Stock Exchange) have operations in more than 40 countries across 6 continents and who’s work on the prestigious Follo Line Project in Norway gained an Award of Merit in the Rail category at the ENR (Engineering News-Record) Global Best Projects competition.

Back to school for US Cyber-Threat leader – Old Street

Representing Somerville, MA based Recorded Future the world’s most sophisticated real-time threat intelligence company, The Levy Group and Landmark Real Estate Advisors of Boston have acquired a fabulous 7,000 sq ft triple-deck suite at the beautifully restored Chapter House, 1 Cranwood Street, EC1 – just a three minute walk from Old Street roundabout in achingly trendy Shoreditch. In just 2 years, Recorded Future’s UK space footprint has grown more than 350% from a small representative office in Rivington Street to moving into a sensationally converted former Victorian schoolhouse. Savings and negotiated incentives of more than £275,000 were accomplished over the initial lease term.

It’s Hammer Time – Southwark

As exclusive advisors to Auction Technology Group, The Levy Group pulled off an incredible deal by successfully assigning the 6,666 sq ft 5th floor at The Harlequin Building on Southwark Street, SE1 to Paragon Building Consultancy achieving savings of almost £900,000 off the bottom line. ATG have built a single digital platform that scales for multiple verticals, regardless of their stage of online development facilitating the sale of 8.9 million items annually by matching goods to buyers at the best available price, combining technology and market expertise to deliver phenomenal results for businesses and informed consumers with limitless expansion capabilities.

GLOBAL MANDATES – ARE THEY EVEN WORTH COMPETING AGAINST ?

Look, let me start by admitting I’m seriously hacked off and since this my blog I’m allowed to blow off steam!

I think I’ve got good reason too. On two recent occasions I was invited to meet senior corporate real estate executives to talk (not pitch) about their office space and despite written assurances to the contrary (sure, we use JLRE International in the US but we’re not tied to a global mandate – we’re free to make our own decisions) – guess what?!

Another potential ‘job’ involved a 60 minute video conference with 12 participants from HR, Real Estate and Finance in Hong Kong and New York plus me and a colleague in London (I’m not making this up) with all the challenges of juggling global time differences. – guess what?!

‘Thank you for your time and presentation but legal have advised us we weren’t supposed to be talking to anyone else locally.’

What complete and utter BS!

We’re a niche international business – small by anyone’s standards but with a platinum client roster we’re really proud of.

If you want to see us ‘up close and personal’ we’ll be there – whether you’re in London or San Francisco.

When I offer to review a prospective client’s office lease and cast an eye over their operating expenses I do it as a professional courtesy. I don’t force anyone to hand over sensitive, confidential information if they don’t want to – they know I’m out for their business and demonstrate my integrity, expertise and local market knowledge so let’s be straight from the get go – I’m a big boy, I can take it.

So, if you’re not strapped into a straight-jacket and you’d genuinely like to talk ‘office space’ I’d be delighted if you’d kindly reach out to me.